Understanding Annual Contract Value (ACV): The Metric Every SaaS Business Needs in 2025

When you’re building or scaling a SaaS company, one of the first questions investors, finance leaders, or even your sales team will ask is: “What’s your Annual Contract Value?”

ACV helps you measure how much revenue each customer contributes on a yearly basis. This single number makes it easier to compare deals, model revenue, and plan growth strategies.

What Is Annual Contract Value (ACV)?

Annual Contract Value (ACV) is the average annual revenue you earn from a customer contract.

- A $90,000 three-year contract = $30,000 ACV.

- A $15,000 one-year contract = $15,000 ACV.

👉 ACV is different from Total Contract Value (TCV), which adds up the entire deal across all years, and from Annual Recurring Revenue (ARR), which combines recurring revenue from all customers.

How to Calculate ACV

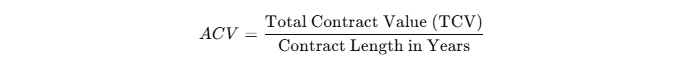

The formula is simple:

Example 1

- Contract: $60,000 over 3 years

- ACV = $60,000 ÷ 3 = $20,000 per year

Example 2

- Contract: $12,000 for 1 year

- ACV = $12,000 ÷ 1 = $12,000 per year

If you’re dealing with multiple contracts, average them together to see your company-wide ACV.

ACV vs ARR vs TCV

| Metric | What It Measures | Best For | Example |

|---|---|---|---|

| ACV | Average annual revenue per contract | Deal comparison, sales strategy | $30K per year |

| ARR | Total recurring revenue from all customers per year | Company-wide forecasting | $500K ARR |

| TCV | Total value of the entire contract | Long-term revenue visibility | $90K over 3 years |

Why ACV Matters for SaaS Companies

- Forecasting: ACV helps you project future revenue with more accuracy.

- Sales performance: Track if reps are closing higher-value or lower-value deals.

- Segmentation: Compare SMB vs enterprise customer value.

- Investor confidence: ACV is often discussed alongside CAC (Customer Acquisition Cost) to measure efficiency.

ACV Benchmarks by Market Segment

While numbers vary widely, here are common ranges:

- SMB SaaS: $1,000–$5,000

- Mid-market SaaS: $5,000–$25,000

- Enterprise SaaS: $25,000+

High ACV usually comes with longer sales cycles but higher lifetime value. Low ACV means faster cycles, but you need more customer volume.

How to Increase ACV

- Upsell and cross-sell: Add premium features or integrations.

- Multi-year contracts: Incentivize customers to commit for longer.

- Bundled services: Package features together to raise average deal size.

- Enterprise focus: Target accounts with larger budgets.

Linking ACV With Other SaaS Metrics

ACV becomes more powerful when paired with other financial metrics:

- Use it alongside Customer Acquisition Cost (CAC) to check if sales spend is justified.

- Compare with profitability metrics using a SaaS profit margin calculator.

- Model future growth scenarios with the SaaS valuation calculator.

- Test sustainability with a cash flow runway calculator.

Together, these numbers paint a complete picture of efficiency, growth, and long-term scalability.

Frequently Asked Questions

What is Annual Contract Value (ACV)?

It’s the average revenue from a customer contract per year.

How do you calculate ACV?

Divide the total contract value by the number of years in the contract.

Is ACV the same as ARR?

No. ACV measures one customer’s annual deal value, while ARR sums revenue across all customers.

Should one-time fees be included in ACV?

Most companies exclude onboarding or setup fees to keep ACV focused on recurring revenue.

What’s a good ACV for SaaS?

It depends on your market. SMB SaaS often sees $1K–$5K, while enterprise deals can exceed $50K.