Measuring the ROI: How to Know if Your Investment Is Paying Off

Measuring ROI isn’t just about crunching numbers—it’s about knowing whether your investments are actually moving the business forward. For SaaS founders, software teams, and companies managing growing cloud bills, ROI (Return on Investment) is the clearest way to separate smart spending from wasted resources.

In this guide, you’ll learn how to calculate ROI, where the simple formula falls short, and how to apply it across SaaS profitability, software development, and cloud cost optimization. Along the way, we’ll link to free ROI calculators that take the guesswork out of the process.

Why ROI Is the First Number You Should Check

When you pour money into a business—whether it’s scaling a SaaS product, building new features, or reducing cloud costs—you eventually face the same question: Is this worth it?

That’s where ROI, or Return on Investment, comes in. Measuring ROI tells you if the resources you’re spending are creating enough financial value. Done right, it’s not just a financial ratio—it’s a decision-making tool that shows where to double down and where to pull back.

What Is ROI and How Do You Calculate It?

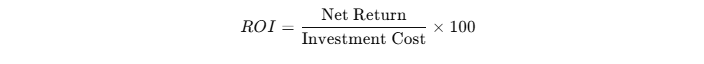

At its core, ROI is a simple percentage:

Example:

- Investment = $50,000

- Return = $75,000

- ROI = (25,000 ÷ 50,000) × 100 = 50% ROI

That means every dollar invested returned $1.50.

Why ROI Alone Can Be Misleading

ROI is powerful, but it’s not perfect. If you’re only looking at short-term numbers, you might miss the bigger picture.

- Time matters: A 20% ROI over one year is far better than 20% over five years.

- Hidden costs: Support, maintenance, and churn can erode returns.

- Intangible gains: Higher customer satisfaction or faster release cycles don’t always show up in the formula.

That’s why many teams combine ROI with metrics like payback period, IRR, or customer lifetime value.

Measuring ROI in SaaS Businesses

For SaaS founders, ROI often comes down to recurring revenue vs. expenses. You can measure profitability by looking at gross margin and net margin.

👉 Try our SaaS Profit Margin Calculator to see how much of your revenue actually turns into profit.

You can also look at ROI through your burn rate and runway. If you’re spending heavily on growth, tools like the Cash Burn Rate Calculator help show how long your capital will last before new funding is required.

ROI in Software Development Projects

Development investments are tricky. You’re often spending large sums upfront, and the returns come months or years later.

Consider questions like:

- Will this feature increase retention or upsell opportunities?

- How much developer time will automation save over a year?

Our Software ROI Calculator makes it easier to compare dev costs against expected business impact. You can also estimate costs with the Software Development Cost Calculator before committing to new projects.

ROI From Cloud and Infrastructure Savings

Cloud bills are notorious for creeping up. Measuring ROI here means comparing optimized vs. unoptimized costs.

For example, shifting workloads, right-sizing instances, or reducing downtime can create real savings. The simplest way to check:

- Calculate your monthly hosting cost today.

- Model expected savings after optimization.

- Apply the ROI formula.

Our Cloud Cost Savings Calculator can help you run the numbers.

Step-by-Step: How to Measure ROI

If you’re new to this, here’s a simple framework you can apply in any business area:

- Define the investment cost (direct + hidden).

- Identify measurable returns (revenue, savings, efficiency gains).

- Apply the ROI formula.

- Adjust for time. A 40% ROI over two years is ~19% annually.

- Compare to benchmarks. In SaaS, 20–40% ROI is often considered healthy, while marketing campaigns might expect 300–500%.

FAQs on Measuring ROI

1. What is a good ROI percentage?

It depends on the industry. SaaS companies may aim for 20–40%, while marketing teams often target much higher.

2. How do you measure ROI in software projects?

Compare total project cost with the revenue or savings the project delivers. Tools like our ROI calculator make this easier.

3. Can ROI include non-financial benefits?

Yes. While harder to quantify, factors like customer satisfaction or risk reduction can be estimated and included.

4. How often should ROI be measured?

For SaaS, quarterly or semi-annual checks are common. For one-time projects, measure at launch and after adoption.

5. What’s the difference between ROI and IRR?

ROI is a simple percentage return. IRR accounts for time and cash flow patterns, making it more complex but also more accurate for long projects.