How to Calculate Customer Acquisition Cost (CAC): A Practical Guide for 2025

Customer acquisition cost (CAC) is one of those numbers every founder, marketer, and investor cares about. It answers a simple but powerful question: How much are you really paying to win a new customer?

If you don’t know your CAC, you risk overspending on ads, hiring sales teams you can’t afford, or running out of cash before hitting product-market fit. Let’s break it down step by step, with formulas, examples, and benchmarks you can actually use.

What Is Customer Acquisition Cost?

Customer acquisition cost (CAC) is the average amount you spend to bring in one paying customer. It covers all of your sales and marketing expenses for a given period.

Think about it as the price tag of growth. If you spend $100,000 on marketing and sales in a quarter and acquire 500 new customers, your CAC is $200.

Basic formula:

CAC = \frac{\text{Total Sales & Marketing Costs}}{\text{New Customers Acquired}}

What to Include in CAC

A common mistake is underestimating CAC because hidden costs are ignored. Here’s what should go in:

- Paid ads (Google, LinkedIn, Meta, TikTok)

- Content creation (writers, design, video production)

- Sales salaries, commissions, and bonuses

- Marketing software (HubSpot, Salesforce, ad tools)

- Agencies, freelancers, contractors

- Events and sponsorships

What’s not included? Product development costs (that belongs to R&D), or customer support for existing users.

Step-by-Step: How to Calculate CAC

- Pick a time frame. Usually monthly or quarterly.

- Add up sales and marketing expenses. Don’t leave out salaries or tools.

- Count the new customers you acquired. Only paying customers, not free trial signups.

- Apply the formula. Divide spend by customers.

Example:

- Sales & marketing spend: $120,000

- New customers: 600

- CAC = $120,000 ÷ 600 = $200 per customer

Variations of CAC You Should Know

- Basic CAC – the standard calculation above.

- Paid CAC – only paid acquisition channels (ads, paid social, sponsorships). Useful if you want to see how much you’re spending on ads compared to organic growth.

- Fully Loaded CAC – includes salaries, software, overhead. This is the version most investors care about.

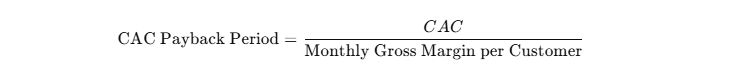

CAC Payback Period

CAC alone doesn’t tell the full story. You also need to know how long it takes to earn back that cost. This is the payback period.

Formula:

If your CAC is $600 and you make $150 in gross margin per customer per month, your payback period is 4 months.

The shorter the payback period, the healthier your business model.

What’s a Good CAC?

There’s no universal number, but there are benchmarks:

- B2B SaaS (SMB market): $200–$1,000 per customer

- Enterprise SaaS: $5,000–$15,000 per customer

- PLG (product-led growth) tools: often under $100

The golden ratio to remember is LTV:CAC = 3:1. That means your customer lifetime value should be at least three times your CAC.

How to Reduce CAC in 2025

With ad prices climbing every year, lowering CAC is about efficiency, not just cutting spend.

- Invest in SEO and content marketing for compounding traffic.

- Use referral programs to encourage word of mouth.

- Improve onboarding and free trials so more users convert.

- Automate ad campaigns with AI-driven tools to cut wasted spend.

- Partner with other SaaS companies for co-marketing opportunities.

Example CAC Table by Business Type

| Business Type | Spend (Sales + Marketing) | New Customers | CAC |

|---|---|---|---|

| SaaS Startup | $100,000 | 500 | $200 |

| E-commerce SMB | $50,000 | 2,000 | $25 |

| Enterprise SaaS | $300,000 | 100 | $3,000 |

Tools That Make CAC Easier

Manually tracking CAC in spreadsheets gets messy. Instead, use specialized tools and calculators to save time.

For example:

- If you’re comparing profitability, try the SaaS profit margin calculator.

- For cash planning, check the cash flow runway calculator.

- If you want to measure long-term sustainability, use the SaaS valuation calculator.

- To see how expenses stack up, test the operating expense ratio calculator.

These tools pair naturally with CAC to give you a complete picture of SaaS unit economics.

Frequently Asked Questions

What is the CAC formula?

Total sales and marketing spend divided by the number of new customers.

What costs should be included in CAC?

Advertising, sales salaries, marketing tools, agencies, and content creation.

What is fully loaded CAC?

A version of CAC that includes salaries, tools, and overhead — not just ad spend.

What is a good LTV:CAC ratio?

3:1 is considered healthy. Below 1:1 means you’re losing money on growth.

How do I calculate CAC per channel?

Track ad spend per channel (e.g., Google Ads, LinkedIn) and divide by new customers from that channel.