Annual Contract Value (ACV) Calculator

What is Annual Contract Value (ACV)?

Annual Contract Value (ACV) represents the average annualized revenue generated from a customer contract, typically excluding any one-time fees. It’s a key metric for SaaS and subscription businesses to understand the yearly value of their customer agreements.

How is ACV Calculated?

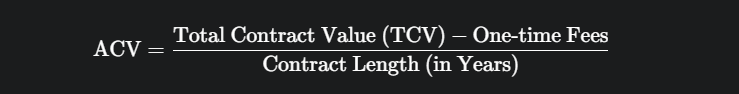

The formula for ACV is:

$$ \text{ACV} = \frac{\text{Total Contract Value (TCV)} – \text{One-time Fees}}{\text{Contract Length (in Years)}} $$

This ensures that the ACV reflects the recurring value of the contract over its duration.

ACV Calculator Tool for SaaS & B2B Businesses

Understanding the real value of your customer contracts is crucial for sustainable growth. Our powerful Annual Contract Value (ACV) Calculator helps SaaS and subscription businesses like yours quickly and accurately determine the annualized revenue from each customer agreement, ensuring you make smarter strategic decisions.

Calculating ACV shouldn’t be complicated. While many calculators offer a basic division, we go deeper to give you the most accurate picture. Unlike simple tools, our calculator specifically accounts for one-time fees, providing a cleaner, truer measure of your recurring revenue stream.

Why an Accurate ACV Matters for Your Business Growth in 2025

In today’s competitive landscape, every metric counts. ACV is more than just a number; it’s a strategic indicator that empowers you to:

- Refine Pricing Strategies: Understand the true annual worth of different contract tiers and adjust your pricing to maximize value.

- Optimize Sales & Marketing Efforts: Identify which customer segments and sales channels yield the highest ACV, allowing you to focus resources where they’ll have the biggest impact.

- Enhance Forecasting & Budgeting: Gain a clearer, more predictable view of your future revenue, enabling more precise financial planning.

- Evaluate Customer Lifetime Value (CLV): ACV is a foundational component for projecting how much revenue a customer will generate over their entire relationship with your business.

- Benchmark Performance: Compare your ACV against industry standards and your own historical data to track growth and identify areas for improvement.

- Identify Upsell & Cross-sell Opportunities: A clear understanding of individual contract values helps pinpoint where additional services or features can add value.

Our Advanced ACV Calculator

Our ACV Calculator is designed with simplicity, accuracy, and user experience at its core. Say goodbye to manual spreadsheets and confusing formulas – get instant, precise results right here.

How Our ACV Calculator Works (and Why It’s Better)

Many calculators use a simplified formula that doesn’t account for the nuances of subscription contracts. Our calculator uses the most widely accepted and accurate formula, ensuring your results are actionable:

Here’s a quick breakdown:

- Total Contract Value (TCV): This is the total revenue you expect to receive from a customer over the entire duration of their contract.

- One-time Fees: These are non-recurring charges, such as setup fees, implementation costs, or professional services, that are paid once at the beginning of the contract. Excluding these ensures your ACV accurately reflects the recurring annual value.

- Contract Length (in Years): The full term of the contract, expressed in years. If your contracts are in months, simply divide the total months by 12.

Why is excluding one-time fees so important?

Imagine a 3-year contract worth $100,000, which includes a $10,000 setup fee. A simple calculator would divide $100,000 by 3, giving you an ACV of ~$33,333. However, the recurring value is only $90,000 ($100,000 – $10,000).

Our calculator correctly divides $90,000 by 3, resulting in an accurate ACV of $30,000. This precision helps you avoid inflating your recurring revenue metrics.

Beyond the Calculation: Actionable Insights for Your Business

Now that you have your ACV, what’s next?

- Segment by ACV: Group your customers by their ACV to identify your most valuable clients (high-ACV) and understand their acquisition costs and retention strategies.

- Compare Against Customer Acquisition Cost (CAC): A healthy business aims for an ACV significantly higher than its CAC. Use your calculated ACV to assess your payback period and ensure your acquisition efforts are profitable.

- Analyze Trends Over Time: Track your average ACV month-over-month or year-over-year. Is it increasing? Decreasing? Understanding these trends helps you adapt your sales, marketing, and product strategies.

- Inform Product Development: High ACV customers often have unique needs. Their contracts can reveal opportunities for new features or premium tiers that command higher prices.

- Strategize for Upsells and Renewals: Knowing the current ACV helps your customer success and sales teams identify prime candidates for expansion revenue and ensure successful renewals.

Frequently Asked Questions (FAQs) About ACV

Q1: What is the difference between ACV and ARR (Annual Recurring Revenue)?

A: ACV (Annual Contract Value) is the average annualized revenue per customer contract, typically excluding one-time fees. It helps you understand the value of an individual deal. ARR (Annual Recurring Revenue) is the total predictable, recurring revenue your business expects to receive annually from all active subscription contracts. While ACV is granular, ARR is an aggregate metric.

Q2: Should I include professional services or one-time setup fees in my TCV for ACV calculation?

A: For an accurate representation of recurring annual value, it’s best practice to exclude one-time fees like professional services or setup costs from the TCV before dividing by the contract length. This is precisely how our calculator operates.

Q3: What’s considered a “good” ACV?

A: A “good” ACV is highly dependent on your industry, business model (e.g., SMB vs. Enterprise), and target market. For SMB-focused SaaS, ACV might be a few thousand dollars, while enterprise SaaS can see ACVs in the tens or even hundreds of thousands. The key is to track your ACV trends and optimize it relative to your business goals and customer acquisition costs.

Q4: How does ACV relate to Customer Lifetime Value (CLV)?

A: ACV is a crucial component of CLV. CLV aims to predict the total revenue a customer will generate throughout their entire relationship with your business. By understanding your ACV and average customer retention period, you can better estimate CLV: CLV = ACV x Average Customer Lifespan (in years).

Ready to Optimize Your Revenue Strategy?

Use our Annual Contract Value (ACV) Calculator today to gain clarity on your recurring revenue and make data-driven decisions that propel your business forward. Bookmark this page for quick access, and feel free to share it with your team!