The SaaS Guide to Customer Lifetime Value

In SaaS, growth isn’t just about signing new customers—it’s about how much value each customer delivers over time. That’s what Customer Lifetime Value (CLV) measures.

CLV shows you the revenue a customer generates throughout their relationship with your business, making it one of the most important metrics for sustainable growth. In this guide, we’ll break down how to calculate CLV, what benchmarks to aim for, and the strategies that actually increase it.

Why CLV Is the Most Important SaaS Metric

For SaaS companies, growth isn’t about a single purchase—it’s about the recurring value a customer delivers over time. That’s where Customer Lifetime Value (CLV) comes in. It tells you how much revenue an average customer will bring during their relationship with your business, adjusted for margins and churn.

Knowing your CLV helps you:

- See whether customer acquisition costs are sustainable.

- Forecast revenue more accurately.

- Focus on retention strategies that deliver the best ROI.

How to Calculate Customer Lifetime Value in SaaS

There are several ways to calculate CLV. The most common SaaS-friendly methods are:

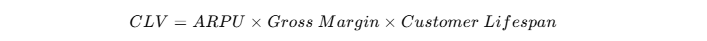

1. Simple Formula

Example:

- ARPU: $100/month

- Gross Margin: 75%

- Avg Customer Lifespan: 24 months

- CLV = $100 × 0.75 × 24 = $1,800

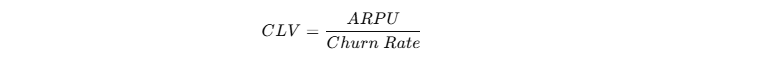

2. Churn-Based Formula

If monthly ARPU is $100 and churn is 5%, then:

CLV = $100 ÷ 0.05 = $2,000

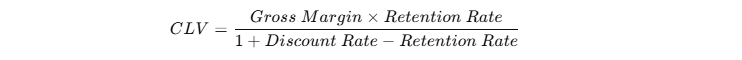

3. Retention-Adjusted Model

Some SaaS teams also use a discounted formula:

This model accounts for time value of money and customer retention dynamics.

👉 If you want to test these scenarios quickly, the Software ROI Calculator makes it easy to plug in your numbers.

Benchmarks: What’s a Good CLV in SaaS?

CLV benchmarks depend heavily on pricing tier:

| SaaS Type | ARPU (monthly) | Typical CLV |

|---|---|---|

| Low-cost SaaS ($10–30) | $10–30 | $300–600 |

| Mid-market SaaS ($50–150) | $50–150 | $1,000–3,000 |

| Enterprise SaaS ($500+) | $500+ | $10,000+ |

Healthy SaaS businesses also target a CLV:CAC ratio of 3:1—meaning a customer should generate at least three times the cost of acquiring them. You can test the profitability of your numbers with the SaaS Profit Margin Calculator.

Why CLV Matters More Than Just Retention or CAC

Focusing on CLV alone isn’t enough—you need to see how it interacts with other key metrics:

- Churn Rate: Rising churn lowers CLV instantly.

- Net Revenue Retention (NRR): Upsells and expansions increase CLV over time.

- Customer Acquisition Cost (CAC): CLV only matters if it exceeds CAC by a healthy margin.

👉 To see how retention impacts real business value, try the Customer Satisfaction Value Calculator.

How to Increase Customer Lifetime Value

- Onboard effectively – Guide new customers to their first success quickly.

- Personalize engagement – Segment by use case and tailor communications.

- Upsell & cross-sell – Expand ARPU with add-ons or premium tiers.

- Proactive support – Solve issues before they lead to churn.

- Product stickiness – Create features that keep users returning daily or weekly.

Retention and engagement drive compounding gains in CLV. Small improvements in churn reduction or ARPU expansion can multiply profitability.

Visualizing the Power of CLV

Here’s a scenario with ARPU = $100 and margin = 75%:

| Avg Lifespan (Months) | CLV ($) |

|---|---|

| 12 months | $900 |

| 24 months | $1,800 |

| 36 months | $2,700 |

A single extra year of retention nearly doubles lifetime value. That’s why CLV is the North Star metric for SaaS growth.

FAQs on SaaS CLV

1. What is CLV in SaaS?

Customer Lifetime Value measures how much recurring revenue a customer generates over their subscription.

2. How do I calculate SaaS CLV?

Multiply ARPU × gross margin × customer lifespan—or divide ARPU by churn rate.

3. Why is CLV important?

It ensures acquisition costs are sustainable and guides retention strategies.

4. What’s a good CLV:CAC ratio?

Most SaaS aim for 3:1 or higher.

5. How can SaaS companies increase CLV?

Improve retention, reduce churn, and expand ARPU through upsells.